Last update images today DKNG Stock: Is Now The Time To Bet Big

DKNG Stock: Is Now the Time to Bet Big?

This week, DKNG stock, the ticker symbol for DraftKings Inc., is generating significant buzz. But is this just seasonal hype, or are there genuine reasons to consider investing? Let's delve into the factors driving the DKNG stock conversation and what you need to know before making any decisions.

DKNG Stock: Understanding the Hype

DraftKings, a leading player in the online sports betting and daily fantasy sports arena, often experiences heightened interest around key sporting events and the release of financial reports. This seasonal trend can influence DKNG stock performance. Examining the recent performance of DKNG stock and the factors contributing to the current market sentiment is essential. Are positive regulatory changes on the horizon? Are there any major partnerships or acquisitions being discussed? Knowing these details can help you understand the basis of the "hype."

DKNG Stock: Analyzing the Business Model

Beyond the seasonal trends, it's crucial to understand the underlying business model driving DKNG stock. DraftKings generates revenue through several avenues, including:

- Sports Betting: Taking bets on sporting events.

- Daily Fantasy Sports: Offering contests with prize pools.

- iGaming: Providing online casino games.

- Advertising and Other Revenue: Generating income through advertising partnerships and other ventures.

The profitability of DKNG stock depends on factors like user acquisition cost, retention rates, and the overall growth of the online gaming market. Consider the competitive landscape. Companies like FanDuel are major players. What differentiates DraftKings and gives it a competitive edge? Are they innovating in areas like in-game betting or offering unique user experiences? This analysis is vital for evaluating DKNG stock's long-term potential.

DKNG Stock: Regulatory Landscape and Expansion

The regulatory environment significantly impacts DKNG stock. As more states legalize online sports betting and iGaming, DraftKings has the opportunity to expand its reach and increase revenue. Monitor legislative developments and regulatory changes closely. Positive regulatory changes are usually a green light for DKNG stock. But the opposite is also true: restrictions can significantly hurt the stock price.

DraftKings is aggressively pursuing market expansion through partnerships and acquisitions. For example, they might partner with a local casino or acquire a technology company to enhance their platform. These strategic moves can positively impact DKNG stock. But be sure to assess the financial implications of these activities. A poorly executed acquisition could negatively affect the stock price.

DKNG Stock: Financial Performance and Valuation

Analyzing DraftKings' financial performance is critical before investing in DKNG stock. Key metrics to consider include:

- Revenue Growth: Is the company consistently increasing its revenue?

- Profitability: Is DraftKings generating profits, or is it still operating at a loss?

- User Growth: Is the company attracting and retaining new users?

- Debt Levels: How much debt does DraftKings have, and how is it managing its finances?

Valuation ratios, such as the price-to-sales (P/S) ratio, can help you determine whether DKNG stock is overvalued or undervalued compared to its peers. Comparing DraftKings to competitors like Penn Entertainment (PENN) and Flutter Entertainment (FLUT) can provide valuable insights. Remember, a high P/S ratio doesn't necessarily mean the stock is overvalued. It could indicate high growth expectations.

DKNG Stock: Risks and Opportunities

Investing in DKNG stock comes with inherent risks and opportunities:

Risks:

- Regulatory Uncertainty: Changes in regulations can significantly impact DraftKings' ability to operate in certain markets.

- Competition: The online gaming market is highly competitive, with many players vying for market share.

- Economic Downturn: A recession could reduce consumer spending on discretionary activities like online gambling.

Opportunities:

- Market Expansion: Continued legalization of online gaming presents significant growth opportunities for DraftKings.

- Technological Innovation: Investing in new technologies, like virtual reality and augmented reality, could enhance the user experience and attract new customers.

- Strategic Partnerships: Collaborating with sports leagues, teams, and media companies can increase brand awareness and user acquisition.

DKNG Stock: Expert Opinions and Analysis

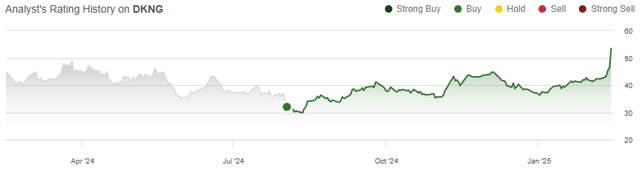

Before investing in DKNG stock, research what analysts and investment experts are saying. What are their price targets? What are their recommendations (buy, hold, or sell)? Remember that expert opinions are not guarantees of future performance, but they can provide valuable insights into the potential risks and rewards of investing in DKNG stock. Consult multiple sources and form your own informed opinion.

DKNG Stock: Long-Term Potential vs. Short-Term Gains

Consider your investment goals and risk tolerance before investing in DKNG stock. Are you looking for long-term growth or short-term gains? DraftKings is a growth company with significant potential, but it also carries inherent risks. If you're looking for a stable, dividend-paying stock, DKNG might not be the right choice. However, if you're comfortable with higher risk and potential reward, DKNG stock could be a suitable addition to your portfolio.

DKNG Stock: Responsible Investing

Online gaming can be addictive, so it's important to promote responsible gambling practices. DraftKings has implemented measures to help users manage their spending and prevent problem gambling. As an investor, you should support companies that prioritize responsible gaming and promote a safe and enjoyable experience for their customers.

Conclusion:

DKNG stock presents both exciting opportunities and significant risks. Seasonal trends certainly contribute to its volatility, but understanding the underlying business model, regulatory landscape, financial performance, and expert opinions is crucial for making informed investment decisions. Carefully consider your own investment goals and risk tolerance before adding DKNG stock to your portfolio.

Summary Question and Answer:

Q: Is DKNG Stock a good investment?

A: It depends on your risk tolerance and investment goals. DKNG has growth potential in a expanding market, but also faces regulatory and competitive challenges. Thorough research and understanding of the risks are crucial before investing.

Keywords: DKNG stock, DraftKings, online sports betting, daily fantasy sports, iGaming, stock market, investment, financial analysis, regulatory landscape, market expansion, revenue growth, profitability, risk assessment, analyst opinions, responsible gambling.

DraftKings DKNG Finance Information Dkng DraftKings Stock Betting On Growth And Legalization In 2025 Med 20241222122332 Charto Dkng DraftKings DKNG Stock Forecast Predictions For 2025 2026 2027 4 Draftkings Prediction Min DraftKings DKNG Stock Forecast For 2024 2025 2026 And Beyond 4 Draftkings Price Forecast For 3 Next Months En DraftKings DKNG Stock Forecast For 2024 2025 2026 And Beyond 5 Long Term Draftkings Analysis For 2024 En DraftKings Stock Soars On Strong Earnings Outlook DKNG 2025 02 14 08 31 13 9d03375a7d5d44ec831068f39cd56bde DraftKings DKNG Stock Forecast Predictions For 2025 2026 2027 2 Draftkings Prediction DraftKings DKNG Stock Forecast Predictions For 2025 2026 2027 Jana Kanne

The 5 Biggest Buyers Of DraftKings DKNG Stock InvestorPlace Dkng1600 1 768x432 DKNG Draftkings Stock Forecast For 2024 2025 2026 And Beyond 5 Long Term Draftkings Analysis For 2024 1 DraftKings Inc DKNG Latest Stock News Headlines Yahoo Finance ScreenshotDraftKings DKNG Stock Forecast Predictions For 2025 2026 2027 3 Draftkings Prediction DraftKings DKNG Stock Forecast Predictions For 2025 2026 2027 2 Draftkings Prediction DraftKings DKNG Stock Forecast Time For A New Monarch Shutterstock 1759562051 DraftKings DKNG Stock Forecast And Price Target 2025 Draftkings Inc Logo DraftKings DKNG Stock Forecast Predictions For 2025 2026 2027 1 Draftkings Prediction En

DraftKings DKNG Stock Forecast For 2025 2026 2027 Sell Or Buy Neutral Exploring The Backspread Strategy 2025 A Guide For Traders Stock Price Of DKNG DKNG Stock Price And Chart NASDAQ DKNG TradingView RVuwTv7C Mid DraftKings Q4 Bold 2025 Ambition But A Corresponding Valuation Rating 52204265 1739623940264366 DraftKings DKNG Stock Forecast Price Prediction 2025 2030 CoinCodex DKNGDraftKings Is The Real MVP Of The 2025 NFL Football Season Financial Med 20240929173525 Chartc Dkng DKNG STOCK MONDAY NEWS Crazy Alert DKNG YouTube Maxresdefault You Can Bet On DraftKings To Rebound In 2025 Entrepreneur Med 20241108094012 Chart Dkng 1182024

DraftKings Q4 Earnings Revenue Jumps 13 To 1 39B Raises 2025 Dkng Lg DKNG Stock Overview All You Need To Know About DraftKings Inc NASDAQ Vstar Trade Draftkings Stock Cfd Dkng Stock Price Performance Fundamental Analysis DKNG Draftkings Inc Stock Price Forecast 2025 2026 2030 To 2050 DKNG DraftKings DKNG Stock Forecast For 2024 2025 2026 And Beyond 3 Draftkings Price Forecast For 3 Next Months En DKNG Draftkings Stock Forecast For 2024 2025 2026 And Beyond 2 Draftkings Price Forecast 1 DraftKings DKNG Stock Forecast For 2024 2025 2026 And Beyond 1 Draftkings Price Prediction Update DKNG Draftkings Stock Forecast For 2024 2025 2026 And Beyond 2 24 DKNG Stock Price And Chart NASDAQ DKNG TradingView U2IFHfSJ Mid

UPDATED VERSION PART 1 DKNG STOCK AND OPTION PLAY NEED IT TO BREAK Updated Version Part 1 Dkng Stock And Option Play Need It V0 Oh9m27jq28h81 DKNG Draftkings Stock Forecast For 2024 2025 2026 And Beyond 7 28 DraftKings Stock Ready For Another Post Earnings Pop Dkng Stock Chart

:max_bytes(150000):strip_icc()/DKNG_2025-02-14_08-31-13-9d03375a7d5d44ec831068f39cd56bde.png)