Last update images today Airbnb Stock: Is Now The Time To Buy

Airbnb Stock: Is Now the Time to Buy?

The question of whether to invest in Airbnb stock (ABNB) is a hot topic, especially with travel trends constantly shifting. This article dives deep into the current landscape, examining factors that influence Airbnb's performance and providing insights to help you make an informed decision about Abnb Stock.

Target Audience: Investors, potential investors, travel enthusiasts, and those interested in the sharing economy.

Abnb Stock: Understanding Airbnb's Business Model

Airbnb (ABNB) revolutionized the travel industry by connecting travelers with homeowners offering unique accommodations. Its platform provides a diverse range of options, from apartments and houses to villas and even unique experiences. Key to understanding Abnb Stock performance is recognizing that Airbnb thrives on:

- Network Effect: More hosts attract more guests, creating a powerful cycle.

- Scalability: The platform is relatively easy to scale, allowing for rapid expansion into new markets.

- Flexibility: Offering various price points and accommodation types caters to a wide range of travelers.

- Experiences: The increasing focus on offering local experiences provides an additional revenue stream.

This model relies heavily on a healthy travel market and economic stability. Changes in travel patterns or economic downturns can directly impact Abnb Stock.

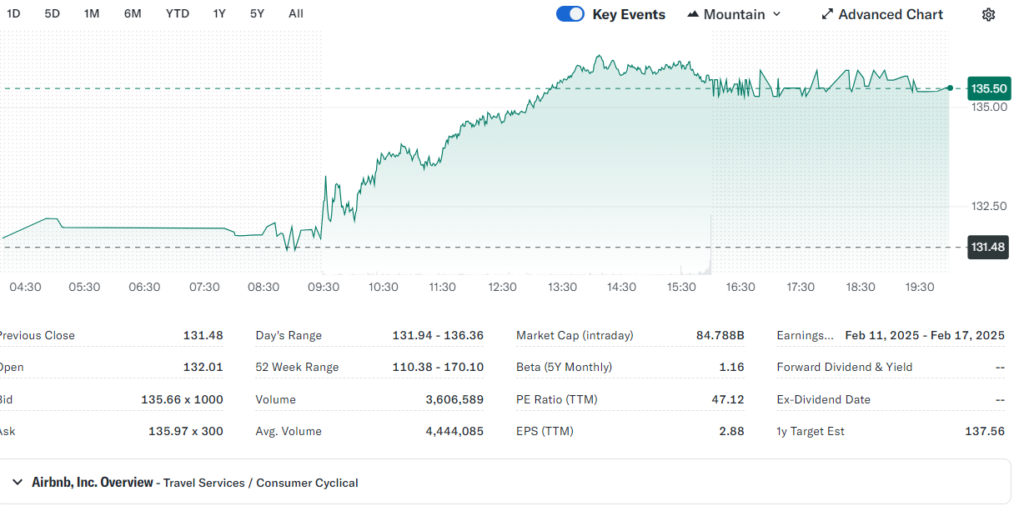

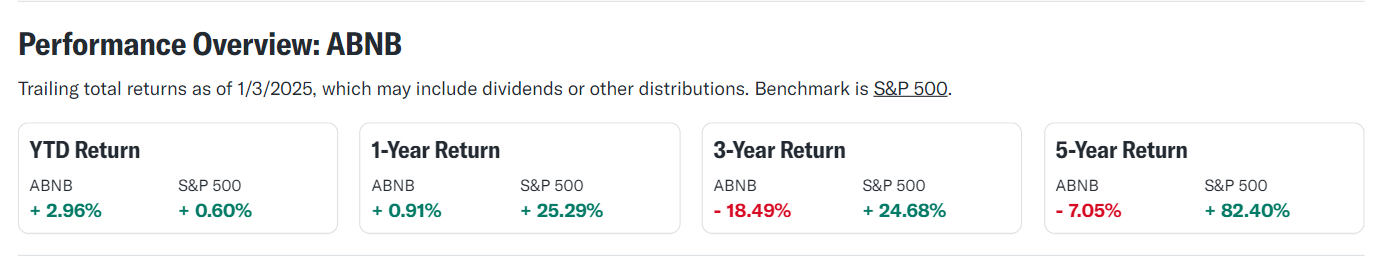

Abnb Stock: Recent Performance and Market Trends

To gauge the current state of Abnb Stock, we need to examine recent performance and overall market trends. The travel industry has seen a significant rebound post-pandemic, benefiting Airbnb significantly.

- Post-Pandemic Recovery: As travel restrictions eased, Airbnb experienced a surge in bookings, driving revenue growth.

- Inflation and Economic Uncertainty: Inflation and the potential for recession can impact travel spending, potentially affecting Airbnb's revenue and, consequently, Abnb Stock.

- Competition: Airbnb faces competition from traditional hotels and other vacation rental platforms.

- Regulatory Landscape: Regulations regarding short-term rentals in various cities can impact Airbnb's operations and potentially affect Abnb Stock sentiment.

Analyzing these factors provides a clearer picture of the current forces impacting Abnb Stock.

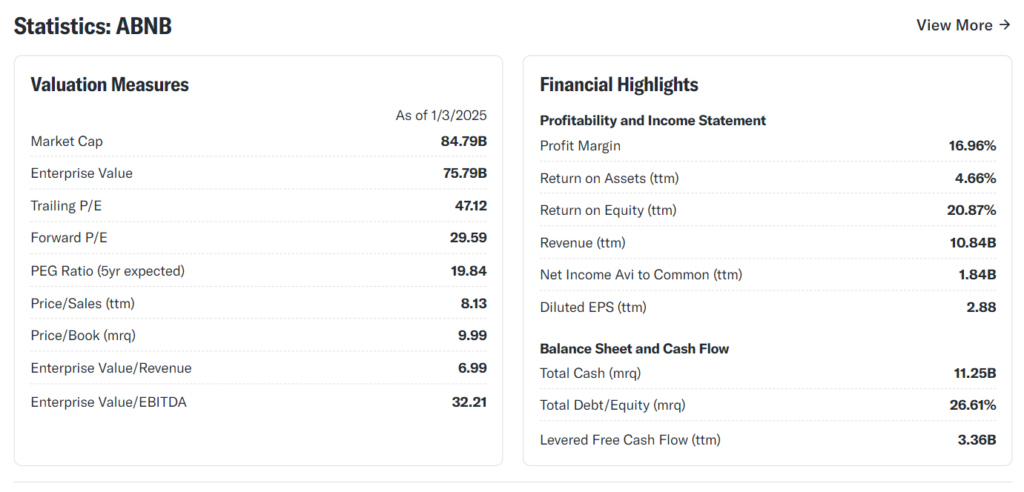

Abnb Stock: Factors Influencing Airbnb's Stock Price

Several key factors influence the price of Abnb Stock. Understanding these drivers is crucial for making sound investment decisions.

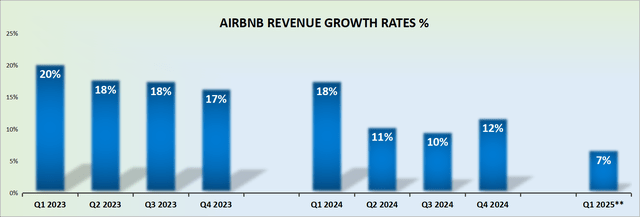

- Revenue Growth: Strong revenue growth driven by increased bookings and occupancy rates typically translates to positive investor sentiment. Monitor Airbnb's quarterly earnings reports closely.

- Profitability: While revenue growth is important, profitability is equally crucial. Watch for improvements in Airbnb's operating margins.

- Global Travel Trends: Shifts in global travel patterns, such as increased international travel or the popularity of certain destinations, can influence demand on the Airbnb platform. Keep an eye on broader travel industry reports.

- Macroeconomic Conditions: Economic factors like inflation, interest rates, and unemployment rates can impact consumer spending and travel budgets, influencing Airbnb's performance and Abnb Stock.

- Company-Specific News: Any significant news related to Airbnb, such as partnerships, acquisitions, or regulatory challenges, can impact the stock price. Stay updated on company announcements and industry news.

Careful analysis of these factors is critical for anticipating potential fluctuations in Abnb Stock.

Abnb Stock: Potential Risks and Challenges

Investing in any stock involves risks, and Abnb Stock is no exception. Here are some potential challenges to consider:

- Economic Downturn: A recession could significantly reduce travel spending, impacting Airbnb's revenue.

- Increased Competition: More players entering the vacation rental market could erode Airbnb's market share.

- Regulatory Scrutiny: Stricter regulations on short-term rentals could limit Airbnb's operations in certain areas.

- Negative Publicity: Incidents related to safety or security on Airbnb properties could damage the company's reputation.

- Seasonality: Travel demand is seasonal, with peak periods typically occurring during the summer and holidays. This seasonality can affect Airbnb's quarterly performance and Abnb Stock.

Being aware of these risks is an essential part of a sound investment strategy.

Abnb Stock: Long-Term Growth Potential

Despite the risks, Airbnb has significant long-term growth potential. Consider these factors:

- Expanding Market: The vacation rental market is still growing, offering opportunities for Airbnb to expand its reach.

- Focus on Experiences: Airbnb's increasing focus on offering unique experiences can attract new customers and generate additional revenue.

- Technological Innovation: Continued innovation in its platform and services can enhance the user experience and attract more hosts and guests.

- Brand Recognition: Airbnb has established a strong brand reputation and loyal customer base.

- Global Expansion: Opportunities exist for Airbnb to expand its presence in emerging markets.

These factors suggest that Abnb Stock could offer significant long-term growth potential, but careful monitoring and evaluation are still necessary.

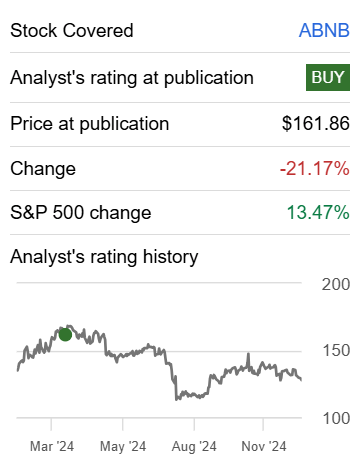

Abnb Stock: Expert Opinions and Analyst Ratings

Before making any investment decision regarding Abnb Stock, it's wise to consult with financial advisors and review analyst ratings from reputable firms. Analyst ratings typically provide a target price and an outlook on the stock's potential performance (e.g., buy, sell, hold). Keep in mind that analyst opinions can vary and should be considered alongside your own research.

Abnb Stock: Question and Answer

Q: Is Abnb Stock a good investment right now? A: It depends on your risk tolerance and investment horizon. Airbnb has strong growth potential but faces economic and regulatory risks. Research thoroughly and consult a financial advisor.

Q: What factors should I consider before buying Abnb Stock? A: Consider Airbnb's revenue growth, profitability, global travel trends, macroeconomic conditions, and company-specific news.

Q: What are the biggest risks associated with Abnb Stock? A: Potential risks include economic downturns, increased competition, regulatory scrutiny, and negative publicity.

Q: What is Airbnb's long-term growth potential? A: Airbnb has potential for growth through market expansion, focusing on experiences, technological innovation, and global expansion.

In summary, Airbnb (Abnb Stock) presents both opportunities and risks for investors. Careful analysis of market trends, company performance, and potential challenges is essential before making an investment decision.

Keywords: Abnb Stock, Airbnb Stock, Airbnb, Travel Stock, Vacation Rentals, Investment, Stock Market, Travel Industry, Stock Analysis, Financial Advice, Investing, Airbnb Stock Analysis.

AMZN TSLA ABNB Top Stock Picks Of 2025 The Watch List Schwab Network Thumbnail Airbnb Inc ABNB Stock Price Prediction And Analysis 2025 2030 Abnb 1024x516 ABNB Airbnb Inc Stock Price Forecast 2025 2026 2030 To 2050 StockScan ABNB Airbnb Inc ABNB Stock Price Prediction And Analysis 2025 2030 Home 6 768x432 Airbnb ABNB Stock Price News Analysis Small 20250206121841 Reportpreview2025 02 Top 7 Nuclear Stocks To Buy N Airbnb Stock Performance Update ABNB Stock Airbnb Stock Performance Update Airbnb ABNB Stock Forecast For 2025 2026 2027 Sell Or Buy Prediction Img 681dc49c32f93 150x150 Airbnb ABNB Stock Technical Analysis And 2025 Forecast Price News Maxresdefault

Airbnb Stock ABNB 2025 Price Quote News And Symbol Abnb Stock Rover Report Airbnb ABNB Stock Forecast For 2025 2026 2027 Sell Or Buy Prediction TOP Stocks About 5 To Buy Now Airbnb Stock NASDAQ ABNB Expanding Scale To Drive More Growth 4ca5bab2d93ede5f8c2b21423e17cc2cAirbnb Earnings Estimates Revised Upward ABNB Stock Airbnb Earnings Estimates Revised Upward Analyst Ratings February 5th 2025 NVDA GOOGL ABNB AC CA ABNB Image 32 Airbnb Inc ABNB Stock Price Prediction And Analysis 2025 2030 Add A Heading 2 768x402 Understanding The Price Surge Airbnb S Cost Advantage Over Airbnb Is Nearly 40 More Expensive Than Its Rivals Here039s Airbnb Stock Price Forecast 2025 Prediction Loria Desiree 1b5b690939fd4671822e21569aa112c5

Airbnb ABNB Stock Price Target Futures And Options Airbnb ABNB 1050x525 Why Airbnb Stock Is Gaining Investor Attention ABNB Stock Why Airbnb Stock Is Gaining Investor Attention Airbnb Stock Price Forecast Here S Why ABNB Is A Strong Buy Airbnb Stock Price 1536x742 ABNB Stock Alert Robert Kiyosaki Says Airbnb Will Crash The Housing Abnb 1600 3 Airbnb Inc ABNB Stock Price Prediction And Analysis 2025 2030 Home 7 768x432 ABNB Airbnb Short Interest And Earnings Date Annual Report Jul 2025 ThumbnailIt S Not Too Early To Talk About 2025 By Sam Ro CFA 972d393a 6b7a 4892 A6c9 2e0dc3e8d307 1918x1168 How To Buy Airbnb ABNB Stocks Shares Forbes Advisor UK Airbnb Lockup Over Gradient

ABNB Airbnb Inc Stock Price Forecast 2025 2026 2030 To 2050 StockScan Stockscan Logo V2 Airbnb Stock Analysis Is ABNB A Must Buy In 2025 YouTube Maxresdefault Airbnb Stock Q4 Earnings Inflection Point Is Here NASDAQ ABNB 17546952 17395120348571546 Airbnb Stock Forecast 2025 2030 2040 2050 Airbnb Stock Price Prediction.webpAirbnb Stock Price Forecast 2025 Forecast Anni Linnea 89 ABNB2025.webpAirbnb Inc ABNB Stock Price Prediction And Analysis 2025 2030 Abnb3 1024x492 ABNB Stock Price Airbnb Chart TradingView Ww2JNPEF Mid Airbnb Inc ABNB Stock Price Prediction And Analysis 2025 2030 Abnb2

Airbnb ABNB Stock A Compelling Investment In 2025 Seeking Alpha 17546952 1736923982365179 ABNB Is Its Stock Price A Worthy Investment Learn More Abnb The Median Technology Stock Price Sales Ratio Airbnb Inc ABNB Stock Price Prediction And Analysis 2025 2030 Ntpcnjhcsdgh 768x429